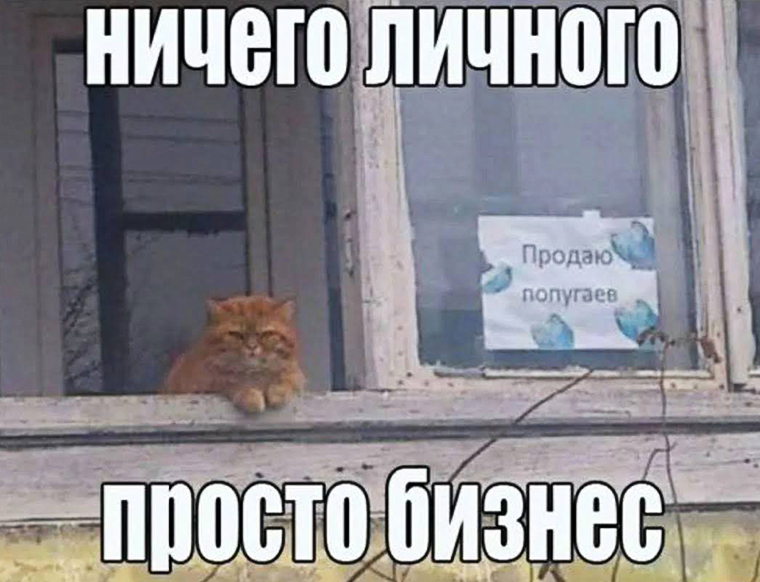

Running a business from home is the bomb: flexible hours, no commute, and your kitchen doubles as the break room and your Zoom conference headquarters! Plus, being a small or medium-sized business owner comes with the perk of poking fun at both the underdogs and those super-successful Instagram influencers raking in millions of followers with their "manifest your dreams" marathons. Some are swapping braggy Bali vacation posts, while others are whining about the government squeezing them dry. But no matter how quirky your hustle is, in the USA, you’ve gotta insure your business—whether it’s selling handmade candles or coaching folks to "live their best life."

Options for Insuring Your Home-Based Business

Your homeowners policy might offer some limited coverage for business stuff, like a computer or small amounts of inventory, but it’s usually not enough for liability, lost income, or bigger equipment needs. A solid business plan (including insurance) is a great starting point to protect your home-based biz. Here are three ways to get the coverage you need:

Boost Your Homeowners Policy with a Business Property Endorsement

You only use a small amount of business property (up to $750) outside your home.

Get an In-Home Business Policy (Not General Liability*)

Your business relies on specialized gear, like photography equipment or tools.

Opt for a Business Owners Policy (BOP)

You have $5,000 or more in business property at home.

Your business income is critical to supporting your household.

Extra Tips for Home-Based Business Owners

Being a smart home business owner goes beyond just insurance. Here are some things to keep in mind:

Not sure where to start? Meet with an insurance agent to figure out what’s best for your specific business needs. They can help you customize a plan that keeps your home and business safe!

Options for Insuring Your Home-Based Business

Your homeowners policy might offer some limited coverage for business stuff, like a computer or small amounts of inventory, but it’s usually not enough for liability, lost income, or bigger equipment needs. A solid business plan (including insurance) is a great starting point to protect your home-based biz. Here are three ways to get the coverage you need:

Boost Your Homeowners Policy with a Business Property Endorsement

- What is it? Your homeowners insurance might cover up to $1,500 of business property (like a desk or product samples) stored at home and up to $750 for business items used off-site (like a laptop you take to a client meeting). If your business is small, this might do the trick! You can often add an endorsement to increase these limits.

- When to consider it: You have less than $5,000 in business property at home.

You only use a small amount of business property (up to $750) outside your home.

- Why it’s great: It’s a simple, affordable way to extend your existing policy for small-scale operations, like a side hustle selling crafts or consulting.

Get an In-Home Business Policy (Not General Liability*)

- What is it? This is a step up from a homeowners endorsement, offering more robust coverage for business equipment and liability. It’s designed specifically for home-based businesses and varies by insurer, so you’ll want to check what’s included (think coverage for computers, inventory, or even customer injuries).

- When to consider it:

Your business relies on specialized gear, like photography equipment or tools.

- Why it’s great: It’s tailored for home businesses, giving you peace of mind without needing a full-blown commercial policy.

Opt for a Business Owners Policy (BOP)

- What is it? A BOP is a comprehensive option that combines property and liability coverage for your business. Unlike homeowners insurance, it covers business-related incidents, like a customer slipping and falling while picking up an order at your home.

- When to consider it:

You have $5,000 or more in business property at home.

Your business income is critical to supporting your household.

- Why it’s great: It fills gaps that homeowners policies miss, especially for liability, and can include extras like business interruption coverage if you can’t operate due to a covered event.

Extra Tips for Home-Based Business Owners

Being a smart home business owner goes beyond just insurance. Here are some things to keep in mind:

- Re-evaluate as you grow: Your insurance needs will change as your business expands, so check in regularly to make sure you’re covered.

- Zoning laws: Pop by your local planning office to confirm your business complies with any zoning rules (some areas restrict home-based businesses).

- Licenses and permits: Look into any permits or licenses needed to run your business legally—don’t skip this step!

- Taxes: Chat with a tax pro about home-based business tax laws and deductions, like the home office deduction, to save some cash.

- Vehicles: If you use your car for business (like deliveries), talk to your insurance agent about adding business-use coverage to your auto policy.

Not sure where to start? Meet with an insurance agent to figure out what’s best for your specific business needs. They can help you customize a plan that keeps your home and business safe!

*In-Home Business Policy vs. General Liability Policy

An In-Home Business Policy is a specialized insurance product designed for home-based businesses. It’s like a tailored package that bundles several types of coverage to protect your business operations at home. Think of it as a one-stop shop for small business owners working out of their homes. It typically includes:

- General Liability Coverage: This protects you if someone (like a customer or delivery person) gets injured at your home due to your business activities or if you accidentally damage someone else’s property. For example, if a client slips while picking up an order at your house, this could cover their medical costs or legal fees if they sue.

- Business Property Coverage: This covers your business equipment, inventory, or supplies (like computers, tools, or product stock) stored at home, in case of damage from things like fire, theft, or other covered events.

- Other Optional Coverages: Depending on the insurer, it might also include things like business interruption (if you can’t work due to a covered loss), data loss, or even off-premises property coverage for items you take outside your home.

A General Liability Policy, on the other hand, is a standalone type of insurance that only covers liability-related risks. It’s broader and not specific to home-based businesses. It protects against claims of bodily injury, property damage, or personal injury (like slander) caused by your business, whether at your home or elsewhere. For example, if you’re a freelancer and accidentally break a client’s equipment while working at their office, a general liability policy could cover it.

Key Differences:

- Scope: An In-Home Business Policy is a combo deal, covering both liability and business property (and sometimes more), while a General Liability Policy focuses solely on liability risks.

- Target: In-Home Business Policies are customized for home-based operations, with limits and features suited for smaller setups. General Liability Policies are used by all kinds of businesses, from home-based to large companies.

- Coverage Needs: If you just need protection for customer injuries or property damage, a General Liability Policy might be enough. But if you also need coverage for your business equipment or inventory at home, an In-Home Business Policy is likely a better fit.

When to Choose an In-Home Business Policy:

- You work from home and have clients visiting (e.g., for tutoring, haircuts, or consultations).

- You have business equipment or inventory (like craft supplies or electronics) that needs protection.

- You want a single policy that covers both liability and property risks without piecing together separate policies.

When a General Liability Policy Might Suffice:

- Your business doesn’t involve much equipment or inventory at home (e.g., you’re a consultant working mostly online).

- You only need coverage for liability risks, like lawsuits from accidents or damages caused by your work.

- You already have other coverage for your business property (like through a homeowners endorsement).

Quick Tip: Check with your insurance provider to see what’s included in their In-Home Business Policy, as offerings vary. If your business grows or involves specialized risks (like professional services), you might need to add a General Liability Policy or even a Professional Liability Policy for extra protection.